Η διαχείριση κινδύνων χωρίς δεδομένα είναι εικασία. Και οι εικασίες σκοτώνουν τα έργα.

Είδαμε εταιρείες να καίνε εκατομμύρια επειδή δεν μπορούσαν να δουν τα προβλήματα που προέκυπταν. Τα προειδοποιητικά σημάδια υπήρχαν. Τα δεδομένα υπήρχαν. Αλλά κανείς δεν συνέδεσε τις τελείες μέχρι που ήταν πολύ αργά.

Το Power BI αλλάζει αυτό το παιχνίδι. Μετατρέπει τα διάσπαρτα δεδομένα κινδύνου σε μια κρυστάλλινη σφαίρα για τα έργα σας. Δεν πρόκειται για μαγεία - απλά για έξυπνη χρήση των πληροφοριών που ήδη έχετε.

Ακολουθεί ο τρόπος με τον οποίο βοηθάμε τους οργανισμούς να μετακινηθούν από την αντιδραστική πυρόσβεση στην προληπτική διαχείριση κινδύνων.

Γιατί η παραδοσιακή διαχείριση κινδύνων αποτυγχάνει

Η διαχείριση των περισσότερων κινδύνων είναι θεατρική. Όμορφα λογιστικά φύλλα με κόκκινο, κίτρινο και πράσινο χρώμα. Μηνιαίες συναντήσεις όπου όλοι γνέφουν και λένε "παρακολουθούμε την κατάσταση".

Το πρόβλημα; Το μητρώο κινδύνων σας βρίσκεται σε ένα στατικό έγγραφο. Τα δεδομένα του έργου σας βρίσκονται σε άλλο σύστημα. Τα οικονομικά σας δεδομένα κρύβονται σε λογιστικό λογισμικό. Τίποτα δεν επικοινωνεί με οτιδήποτε άλλο.

Όταν ένας κίνδυνος υλοποιείται, προσπαθείτε να καταλάβετε τι συνέβη. Παίρνετε αναφορές από πέντε διαφορετικές πηγές. Μέχρι να έχετε απαντήσεις, η ζημιά έχει γίνει.

Βλέπουμε αυτό το μοτίβο παντού:

- Υπερβάσεις του προϋπολογισμού που "ήρθαν από το πουθενά" - μόνο που τα στοιχεία για τις δαπάνες έδειχναν την τάση τρεις μήνες νωρίτερα

- Έλλειψη πόρων που "δεν μπορούσε να προβλεφθεί" - ενώ οι εκθέσεις χρήσης φώναζαν προειδοποιήσεις

- Ζητήματα ποιότητας που "εμφανίστηκαν ξαφνικά" - αν και τα ποσοστά ελαττωμάτων είχαν αυξηθεί επί εβδομάδες

Τα δεδομένα υπήρχαν. Η ορατότητα δεν υπήρχε.

Το Power BI ως πλατφόρμα πληροφοριών κινδύνου

Το Power BI δεν φτιάχνει μόνο όμορφα διαγράμματα. Συνδέει τα σημεία κινδύνου πριν γίνουν εκρήξεις κινδύνου.

Σκεφτείτε το ως το κέντρο διοίκησης κινδύνων. Κάθε πηγή δεδομένων που έχει σημασία τροφοδοτείται σε ένα μέρος. Εργαλεία διαχείρισης έργων, οικονομικά συστήματα, βάσεις δεδομένων ανθρώπινου δυναμικού, μετρήσεις ποιότητας - όλα μιλούν την ίδια γλώσσα.

Κατασκευάζουμε πίνακες ελέγχου που σας δείχνουν τρία πράγματα:

- Τι συμβαίνει τώρα - Υγεία του έργου σε πραγματικό χρόνο σε όλες τις πρωτοβουλίες σας

- Ποια μοτίβα αναδύονται - Τάσεις που προβλέπουν τα προβλήματα πριν αυτά εκδηλωθούν

- Ποιες ενέργειες πρέπει να γίνουν - Σαφή επόμενα βήματα με βάση τα δεδομένα

Η μαγεία συμβαίνει όταν σταματήσετε να κοιτάτε μεμονωμένες μετρήσεις και αρχίσετε να βλέπετε τις συνδέσεις. Η απόκλιση του προϋπολογισμού συν τη χρήση των πόρων συν την πίεση του χρονοδιαγράμματος ισοδυναμεί με ένα έργο έτοιμο να καταρρεύσει.

Το Power BI καθιστά αυτές τις συνδέσεις ορατές. Και η ορατότητα δημιουργεί επιλογές.

Δημιουργία του συστήματος ανίχνευσης κινδύνων

Δεν κατασκευάζουμε πίνακες οργάνων. Χτίζουμε συστήματα έγκαιρης προειδοποίησης.

Ξεκινήστε με τα μεγαλύτερα σημεία του πόνου σας. Ποιοι κίνδυνοι σας πληγώνουν περισσότερο; Διαρροές του προϋπολογισμού; Καθυστερήσεις στο χρονοδιάγραμμα; Συγκρούσεις πόρων; Αποτυχίες ποιότητας;

Για κάθε σημαντική κατηγορία κινδύνου, προσδιορίστε τους προπορευόμενους δείκτες. Όχι τα προφανή πράγματα - τα ανεπαίσθητα σήματα που εμφανίζονται εβδομάδες πριν από την κρίση.

Δείκτες δημοσιονομικού κινδύνου:

- Ταχύτητα πραγματικών έναντι προγραμματισμένων δαπανών

- Συχνότητα και τιμή αιτήματος αλλαγής

- Καθυστερήσεις πληρωμών προμηθευτών

- Χρόνος έγκρισης παραγγελίας αγοράς

Δείκτες κινδύνου χρονοδιαγράμματος:

- Ποσοστά ολοκλήρωσης εργασιών σε σχέση με τη βασική γραμμή

- Κατανάλωση ρυθμιστικού διαύλου κρίσιμης διαδρομής

- Προβλέψεις διαθεσιμότητας πόρων

- Καθυστερήσεις ολοκλήρωσης της εξάρτησης

Δείκτες κινδύνου ποιότητας:

- Ποσοστά ανακάλυψης ελαττωμάτων ανά φάση

- Ποσοστά επανεπεξεργασίας

- Δοκιμές κενών κάλυψης

- Τάσεις του συναισθήματος των πελατών

Συνδέουμε αυτούς τους δείκτες με αυτοματοποιημένες ειδοποιήσεις. Όταν τα μοτίβα μετατοπίζονται πέρα από τα φυσιολογικά όρια, οι κατάλληλοι άνθρωποι ειδοποιούνται αμέσως. Όχι στη συνάντηση επισκόπησης κινδύνου του επόμενου μήνα. Τώρα.

Μετατροπή των πληροφοριών σε δράση

Τα δεδομένα χωρίς δράση είναι απλώς ακριβή ψυχαγωγία.

Σχεδιάζουμε τις λύσεις μας Power BI γύρω από τα σημεία λήψης αποφάσεων, όχι μόνο γύρω από τα σημεία δεδομένων. Κάθε ταμπλό απαντά σε συγκεκριμένα ερωτήματα που οδηγούν σε συγκεκριμένες ενέργειες.

Ερωτήσεις για το Executive Dashboard:

- Ποια έργα χρειάζονται άμεση προσοχή;

- Πού πρέπει να ανακατανείμουμε τους πόρους;

- Ποιοι κίνδυνοι απειλούν τους στρατηγικούς μας στόχους;

Ερωτήσεις για τον πίνακα ελέγχου του διαχειριστή έργου:

- Ποιες εργασίες καθυστερούν;

- Ποια μέλη της ομάδας είναι υπερφορτωμένα;

- Πού ανακύπτουν ζητήματα ποιότητας;

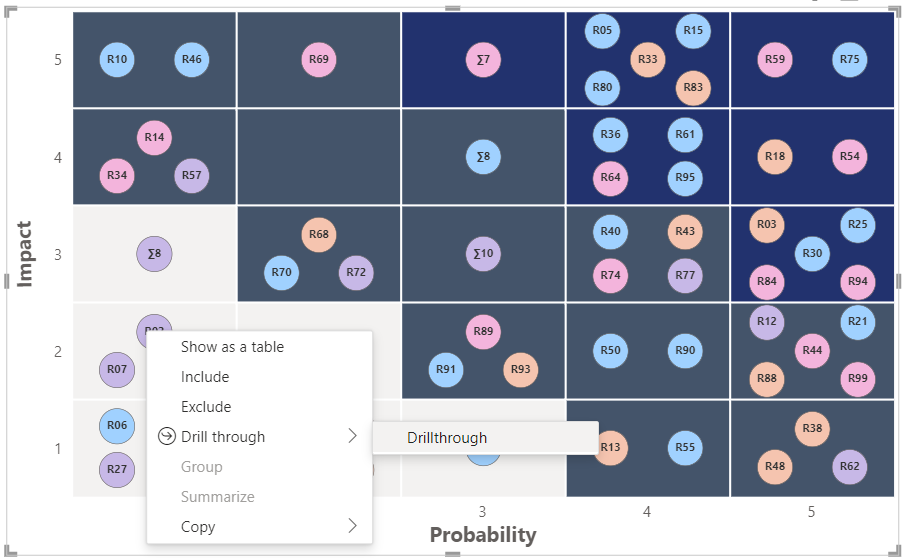

Ερωτήσεις για το Dashboard του Risk Manager:

- Ποια σενάρια κινδύνου γίνονται πιο πιθανά;

- Ποιες στρατηγικές μετριασμού αποδίδουν;

- Πού χρειαζόμαστε νέους ελέγχους κινδύνου;

Κάθε πίνακας οργάνων περιλαμβάνει συνιστώμενες ενέργειες με βάση τα μοτίβα δεδομένων. Δεν χρειάζεται να μαντεύετε τι πρέπει να κάνετε στη συνέχεια. Καμία παράλυση ανάλυσης.

Δημιουργούμε επίσης δυνατότητες μοντελοποίησης σεναρίων. "Τι θα συμβεί στο χρονοδιάγραμμά μας αν χάσουμε αυτόν τον βασικό πόρο;" "Πώς επηρεάζει τα παραδοτέα μας μια περικοπή του προϋπολογισμού του 20%;" Απαντήστε σε αυτά τα ερωτήματα προτού γίνουν πραγματικότητα.

Πραγματική επιτυχία στη διαχείριση κινδύνων

Ένας πελάτης μεταποιητικής βιομηχανίας έχανε χρήματα από κατασκευαστικά έργα. Οι υπερβάσεις του προϋπολογισμού ήταν κατά μέσο όρο 30%. Οι καθυστερήσεις του χρονοδιαγράμματος ήταν ρουτίνα.

Συνδέσαμε τα δεδομένα διαχείρισης έργων, τα συστήματα προμηθειών και τις οικονομικές αναφορές τους στο Power BI. Τα μοτίβα έγιναν αμέσως εμφανή.

Οι αυξήσεις του κόστους των υλικών δεν επισημαίνονταν μέχρι τις μηνιαίες αναθεωρήσεις του προϋπολογισμού. Μέχρι τότε, οι παραγγελίες αγοράς είχαν ήδη εκδοθεί σε διογκωμένες τιμές. Οι εντολές αλλαγής δεν αξιολογούνταν με βάση τις συνολικές επιπτώσεις του έργου - μόνο τις επιπτώσεις των επιμέρους εργασιών.

Οι συγκρούσεις πόρων μεταξύ έργων δεν ήταν ορατές μέχρι που οι άνθρωποι δεν εμφανίζονταν για να εργαστούν.

Η λύση Power BI δημιούργησε ορατότητα σε πραγματικό χρόνο σε αυτούς τους διασυνδεδεμένους κινδύνους. Οι ειδοποιήσεις για το κόστος των υλικών προκάλεσαν άμεσες αναθεωρήσεις των προμηθειών. Οι επιπτώσεις των εντολών αλλαγής αξιολογήθηκαν σε σχέση με τους περιορισμούς του χαρτοφυλακίου, όχι μόνο των μεμονωμένων έργων.

Η κατανομή των πόρων έδειχνε τις συγκρούσεις εβδομάδες νωρίτερα, επιτρέποντας προληπτικές προσαρμογές στον προγραμματισμό.

Αποτελέσματα μετά από έξι μήνες: 8%. Η απόδοση του χρονοδιαγράμματος βελτιώθηκε κατά 40%. Το πιο σημαντικό, σταμάτησαν να εκπλήσσονται από τα προβλήματα.

Μια εταιρεία ανάπτυξης λογισμικού χρησιμοποίησε παρόμοιες προσεγγίσεις για τη διαχείριση των κινδύνων ποιότητας. Αντί να εντοπίζουν ελαττώματα στις δοκιμές αποδοχής από τον χρήστη, εντόπιζαν πρότυπα υποβάθμισης της ποιότητας κατά τη διάρκεια της ανάπτυξης.

Τα ποσοστά απόρριψης της αναθεώρησης κώδικα, οι τάσεις κάλυψης δοκιμών μονάδας και οι συχνότητες αποτυχίας κατασκευής προέβλεπαν τα προβλήματα ποιότητας τρία sprints νωρίτερα. Αυτό τους έδωσε χρόνο να προσαρμόσουν τις διαδικασίες πριν παραδώσουν χαλασμένο λογισμικό.

Οι βαθμολογίες ικανοποίησης των πελατών βελτιώθηκαν 25% επειδή λιγότερα ελαττώματα έφτασαν στην παραγωγή.

Στρατηγική υλοποίησης που λειτουργεί πραγματικά

Μην προσπαθείτε να λύσετε κάθε πρόβλημα κινδύνου από την πρώτη ημέρα. Αυτή είναι η συνταγή της ακριβής αποτυχίας.

Ακολουθούμε μια εστιασμένη προσέγγιση:

Φάση 1: Διαλέξτε ένα μεγάλο πρόβλημα

Επιλέξτε τον πιο ακριβό ή πιο συχνό κίνδυνο. Δημιουργήστε ικανότητες ανίχνευσης και αντιμετώπισης για αυτό το ζήτημα. Φροντίστε να λειτουργεί τέλεια πριν προσθέσετε πολυπλοκότητα.

Φάση 2: Σύνδεση σχετικών πηγών δεδομένων

Αφού λειτουργήσει το βασικό σας σύστημα, προσθέστε πηγές δεδομένων που παρέχουν πρόσθετο πλαίσιο. Χρηματοοικονομικά δεδομένα για τους κινδύνους του προϋπολογισμού. Δεδομένα πόρων για κινδύνους χρονοδιαγράμματος. Ανατροφοδότηση πελατών για κινδύνους ποιότητας.

Φάση 3: Επέκταση σε συναφείς κινδύνους

Χρησιμοποιήστε το δοκιμασμένο σας πλαίσιο για να αντιμετωπίσετε την επόμενη μεγαλύτερη κατηγορία κινδύνου. Θα κινηθείτε ταχύτερα, επειδή υπάρχει η υποδομή.

Φάση 4: Δημιουργία μοντέλων πρόβλεψης

Με τη ροή ιστορικών δεδομένων, αναπτύξτε προγνωστικές αναλύσεις. Μοντέλα μηχανικής μάθησης που προβλέπουν την πιθανότητα κινδύνου με βάση τις τρέχουσες συνθήκες.

Η προσέγγιση αυτή απαιτεί 6-12 μήνες για την πλήρη εφαρμογή. Αλλά βλέπετε αποτελέσματα από τη Φάση 1 μέσα σε λίγες εβδομάδες.

Επιμένουμε επίσης στη διαχείριση της αλλαγής παράλληλα με την τεχνική υλοποίηση. Το καλύτερο ταμπλό στον κόσμο αποτυγχάνει αν οι άνθρωποι δεν το χρησιμοποιούν. Η εκπαίδευση, η ενσωμάτωση των διαδικασιών και η υιοθέτηση της κουλτούρας είναι εξίσου σημαντικές με τις συνδέσεις δεδομένων.

Μέτρηση της ROI της διαχείρισης κινδύνων

Η καλή διαχείριση κινδύνων εξοικονομεί χρήματα. Η καλή διαχείριση κινδύνων φέρνει χρήματα.

Παρακολουθούμε συγκεκριμένες μετρήσεις για να αποδείξουμε τον αντίκτυπο του Power BI στη διαχείριση κινδύνων:

Άμεση εξοικονόμηση κόστους:

- Μειωμένες υπερβάσεις του προϋπολογισμού

- Λιγότερες προσθήκες πόρων έκτακτης ανάγκης

- Χαμηλότερο κόστος επανεπεξεργασίας και ποιότητας

- Μειωμένα ποσοστά ακύρωσης έργων

Έμμεση δημιουργία αξίας:

- Βελτιωμένη ικανοποίηση των πελατών

- Ενισχυμένη παραγωγικότητα της ομάδας

- Καλύτερη αξιοποίηση των πόρων

- Ταχύτερη παράδοση έργων

Βελτιώσεις στην αντιμετώπιση κινδύνων:

- Νωρίτερη ανίχνευση προβλημάτων

- Ταχύτερη λήψη αποφάσεων

- Ακριβέστερες εκτιμήσεις επιπτώσεων

- Καλύτερη αποτελεσματικότητα του μετριασμού

Οι περισσότεροι οργανισμοί βλέπουν 3-5πλάσια απόδοση επένδυσης εντός του πρώτου έτους. Η εξοικονόμηση αυξάνεται με την πάροδο του χρόνου καθώς ωριμάζουν οι δυνατότητες διαχείρισης κινδύνων.

Το πιο σημαντικό είναι ότι κοιμάστε καλύτερα τη νύχτα. Δεν θα έχετε πλέον δυσάρεστες εκπλήξεις στις συσκέψεις της Δευτέρας το πρωί. Δεν χρειάζεται να εξηγείτε στα στελέχη γιατί τα έργα απέτυχαν χωρίς προειδοποίηση.

Η διαχείριση των κινδύνων γίνεται προληπτική αντί για αντιδραστική. Προλαμβάνετε τα προβλήματα αντί απλώς να τα τεκμηριώνετε.

Το Power BI μετατρέπει τα δεδομένα σας σε πρόβλεψη. Και η πρόβλεψη μετατρέπει τη διαχείριση κινδύνων από κέντρο κόστους σε ανταγωνιστικό πλεονέκτημα.

Το ερώτημα δεν είναι αν μπορείτε να αντέξετε οικονομικά να εφαρμόσετε καλύτερη διαχείριση κινδύνων. Το ερώτημα είναι αν έχετε την πολυτέλεια να μην το κάνετε.

Οι ανταγωνιστές σας χρησιμοποιούν ήδη δεδομένα για να βλέπουν γύρω από τις γωνίες. Το να προλαβαίνετε τη διαχείριση κινδύνων κοστίζει ακριβά. Η πρωτοπορία στο παιχνίδι είναι κερδοφόρα.